How to Pay MCGM Property Tax Payment 2024-25 ? BMC Tax Payment in Paytm APP. Procedure to Pay Property Tax in Mumbai. Mumbai (BMC) Property Tax Online Payment Step by step at https://ptaxportal.mcgm.gov.in/CitizenPortal/

MCGM Property Tax

The MCGM Property Tax 2024-2025: Municipal Corporation of Greater Mumbai (MCGM) is the governing body of the Business Capital of our Country. MCGM is also Known as Brihanmumbai Municipal Corporation(BMC). Citizens who own properties within the boundaries of BMC are liable to pay taxes to the Brihanmumbai Municipal Corporation. Lets know the detailed procedure of paying the MCGM Property Tax Payment in different methods available.

BrihanMumbai Municipal Corporation

Mumbai has a large number industries and business firms and it is the Capital city of Maharashtra State. MCGM was established in 1889 under the Bombay municipality Act 1888. It is a 134year old corporation and it has an annual budget higher than many smaller Indian states. The revenue of BMC is highly dependent on the property taxes paid by its people. Mr. Iqbal Singh Chahal I.A.S is the sitting Municipal Commissioner cum administrator of this huge Municipal Corporation. There about 2.2crore people living in Mumbai. According to GDP rate Mumbai is the largest City in India. It occupies an area of 157Km2 and is located in Konkan district of Maharashtra. There are several properties in Bombay and each Property owner should pay the property tax annually.

MCGM Property Tax Payment Online 2024-25

MCGM Property Tax Payment Methods

People of Mumbai can pay the property tax in different methods. One can pay the tax in Online Mode using the official portal or by Using Paytm Mobile App or By Physical Visit in Offline Mode. Here is the stepwise guide to pay tax in 3different methods.

Mumbai Tax Payment 2024-25 Online Procedure

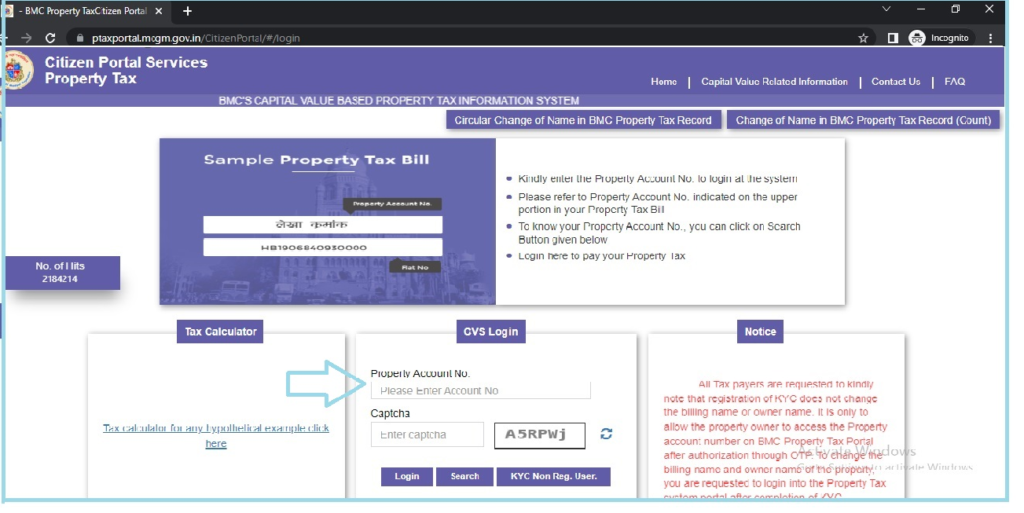

- Enter the link in your web browser given below. https://ptaxportal.mcgm.gov.in/CitizenPortal/#/login

- You’ll enter the BMC’s Official Citizen Portal.

- Some disclaimers for citizens convenience will appear and after that you will be able to see the login options.

- Now Enter the Property Account Number and type the given captcha to login into your account.

- Verify the property details along with tax details that are available on the page. After confirming the details click on Continue and enter the payable amount.

- You can make the payment using Net Banking or Credit Cards or Debit Cards.

- A receipt will be generated after successful payment. Download and keep it safe for future references.

Ptaxportal.mcgm.gov.in/CitizenPortal/#/login

MCGM Property Tax Payment in PAYTM APP

Payment of MCGM Property Tax Using Paytm App: As India is going cashless and encouraging digital payments. MCGM facilitates its citizens to pay the property tax using Paytm App. All Android and Apple mobile devices support Paytm Mobile App. So MCGM provides the facility to pay the property tax using Paytm Mobile App or using Paytm website. One should have Paytm Account and bank account linked o Paytm to pay MCGM Property Tax. Download Paytm app through this link https://paytm.com/download-paytm-app Procedure of Payment is as follows.

- Open Paytm App in the mobile or browser, search for Recharges and Bills option.

- Click on view more and scroll down. You’ll see Financial Services option under Recharges and Bills head.

- Click On Municipal Tax Option available there.

- In the search bar type “MCGM Property Tax”.

- Select Property Tax option in ULBCode/Local Body options.

- Then enter Your Property Account Number and click on Proceed.

- The screen will display your property details. Verify them and check the amount payable.

- If everything is correct then choose the mode of payment you would like to prefer and make the payment.

- Down the payment receipt it contains a unique transaction id save it securely.

Offline Process of Paying MCGM Property Tax

- Offline tax payment can be made using any service centers which have right to pay taxes.

- One should visit the center physically and should carry the required property details like property account number and owner name.

- One can ask the assistant revenue officer or visit the citizen facilitation centers to pay the property tax.

- Citizens can pay the property Tax in MCGM using Demand Drafts, Cash, Cheque or Upi Payments directly to the service providers.

- The service operator will give a payment receipt after successful property tax payment and you should keep it safe.

MCGM Property Tax Calculator 2024

Property Tax in MCGM varies depending upon the location, age, type of construction, type of usage of the property and the actual carpet area along with the capital value of the Property.

Formula for calculation of Property Tax in MCGM:

Property Tax = Capital Value * Tax rate

where Capital Value is the product of Market value of the property, Total carpet area, Weight for construction type and Weight for the age of the building.

You can use the tax calculator option available on the BMC’s Official Citizen Portal.

Click on the Tax calculator and enter the required details and click on calculate option then you can see the entire tax calculation of the property.

Properties Exempted From Tax Payment in MCGM

- 100% concession is given to properties under 500sq.ft.

- Public places of worship like temples, churches, masjids and mosques etc. have complete tax exemption.

- There is 60% tax concession on Flats or houses measuring under 500-700sq.ft.

Last Date and Penalty

30th June of every year is the last date for tax payment in MCGM. There is a late fee of 2% rate of interest on the entire tax amount applicable for all delayed payments per month.

If you also know how to pay tax property tax for properties in Karnataka Bangalore (BBMP) Click on This Link https://www.npcindia.org/bbmp-property-tax-online/.

Can I Pay the MCGM property tax directly using Paytm?

Yes, the Bombay property tax can be directly paid using Paytm mobile application or Paytm web browser.

Is the property tax same for all residential buildings in MCGM?

No the property tax amount depends on various factors like type, age, carpet area, market value of the property.